Ships will be compelled to burn cleaner fuel in Northern Europe and North America from the beginning of next year, but what impact will this have on box carriers and their customers? As from the beginning of next year, all vessels sailing through Northern Europe’s and North America’s Emission Control areas (ECAs) will be compelled to burn much cleaner fuel (see map). Instead of consuming Heavy Fuel Oil with a maximum sulphur content of less than 1% (HFO 1.0%S), which is already much cleaner than the global standard of 3%, the maximum sulphur content will be reduced to 0.1%. This can only be achieved by fitting expensive exhaust scrubbers, consuming LNG, or burning Marine Gas Oil (MGO). Ships in port are already subject to the HFO 0.1%S restriction.

Northern Europe’s and North America’s Emission Control Areas

Out of the three alternatives, only consuming MGO at sea is practical in the short-to-medium term. Although some deep-sea ships are now being ordered with duel LNG/HFO fuel engines, the loss of cargo space required for their fuel tanks is enormous, and major cities are still reluctant to see fuelling stations for hazardous gas like LNG built in nearby ports. Ship exhaust scrubbers may also rule the world one day, but few, if any, container ships have them installed yet.

As MGO fuel is currently around $300 per tonne more expensive that HFO 1.0%S, several ocean carriers have started warning customers to expect a surcharge. The following statement from Hapag-Lloyd on 7 November 2013 is a good example: ‘For all freight rates with a validity in 2015, customers will have to amend their bunker formulas to cover the increasing costs for low sulphur fuel oil. Otherwise, Hapag-Lloyd reserves the right to charge an increased LSF surcharge separately once all cost components are confirmed.’

So far Hapag-Lloyd has only mentioned that it will bear an additional fuel burden of $120-200 million based on today’s fuel prices and service network. Maersk/Safmarine/Seago have mentioned an additional fuel cost of about $200 million.

As no carrier has yet been more specific, Drewry has done its own research into the extra costs involved and the likely consequences of the new environmental regulation.

The cost analysis is not easy as it depends on several variables, including;

the port rotation of each service, and the resulting sailing time spent in the relevant ECAs (i.e. in the US, in Northern Europe or in both)

the daily fuel consumption of each ship (larger, more economical ships will incur lower per-unit extra costs)

how long before entering each ECA ships will be compelled to switch from HFO to MGO in order to ensure compliance

the extra engine wear and tear resulting from burning MGO instead of HFO

the future cost differential between HFO 1.0%S and more expensive MGO

Out of these, factors (4) and (5) are the hardest to predict, in Drewry’s opinion.

Factors (1) and (2) are not only route-specific, but also port-specific, so there will be differences between each trade routes’ and services’ extra costs caused by the new low-sulphur rule.

Each trade lane has very different economies of scale. The average size of vessel deployed between Asia and Northern Europe is now a massive 11,200 teu, compared to only 6,450 teu between Asia and USWC, and 4,100 teu between the USEC/Gulf and Northern Europe, for example. And within each route, the average size of vessel deployed in services can also vary enormously, ranging from 8,000 teu to 18,000 teu between Asia and North Europe. Also, some ships are far more fuel efficient than others, and run at different speeds when crossing ECAs in different directions, and it is not always evident when the change-overs occur.

Another complication is that ocean carriers serve trade lanes in different ways, with some schedules involving more coastal steaming within ECAs than others. Some ships sailing between Northern Europe and ECNA only go as far as Savannah, whilst others go on to Houston, for instance. So, if a carrier wants to add a port of call which results in having to bear the cost of the more expensive fuel for say 300 miles within an Emission Control area, the incremental fixed cost of adding this port call will be much higher than it is today.

This means that the low-sulphur regulation could:

eventually lead to vessels calling at fewer direct ports within Emission Control areas

discriminate between ports located within Emission Control areas (eg Northern France) and those outside (eg Mediterranean France)

discriminate between upriver ports (requiring more time sailing) and coastal ports within Emission Control areas

substantially increase the cost advantage of larger, more fuel efficient ships over smaller, older ships

increase costs for carriers and for shippers

But how much will this extra cost be?

We provide here an estimate of the additional cost to the carrier of the low-sulphur regulation for two transatlantic services only, but it should be borne in mind that other routes, such Asia/North Europe and Asia/North America, will be far less costly due to there being only one ECA involved. Drewry has analysed these routes too, but the results go beyond the scope of this particular piece of free analysis.

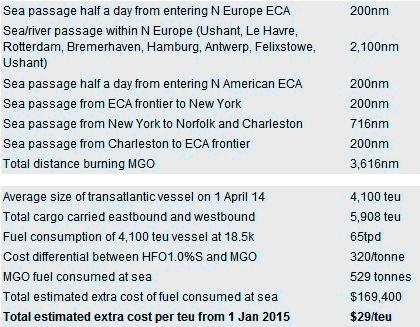

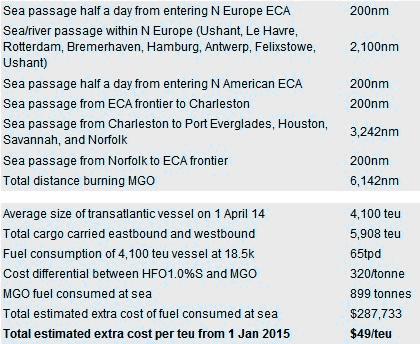

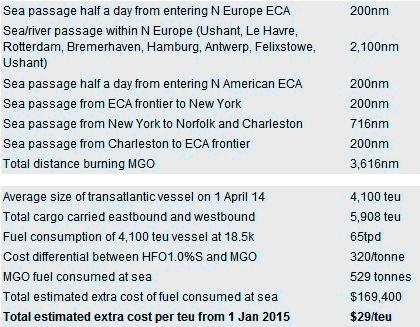

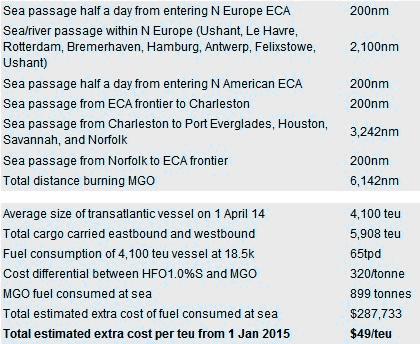

As can be seen from Tables 1 and 2, the round voyage cost differential of services operating between Northern Europe and USEC is approximately $29/teu, and the difference between Northern Europe and the US Gulf is $49/teu. There will also be additionals for feeding cargo between Continental ports and the Baltic, and between Continental ports and the UK East and West coasts. For a typical round voyage between Hamburg and St Petersburg, the cost will be a further $21/teu, for example.

The calculations assume that the cost differential between MGO and HFO 1.0%S will increase from $300/tonne now to $320/tonne in 2015. This is because the differential could well increase due to increased demand for MGO. Fuel consumption between MGO and HFO is assumed to be the same. It is possible that carriers will want to charge for extra engine wear and tear caused by burning MGO instead of HFO whilst at sea, but this factor has been ignored in the calculations. The same applies to the extra deep-sea distance ocean carriers will have sail in order to ensure that transits across each ECA is minimised. We assume that ships will switch to MGO half a day before entering each ECA in order to clean all pipes/filters in good time.

The extra cost on a per teu basis may seem low compared to the global ‘telephone’ numbers, mentioned by Maersk and Hapag-Lloyd at the outset, but it should be borne in mind that the costs will represent a significant part of ocean carriers’ overall fuel bill. For example, for the two services mentioned, ocean carriers’ HFO cost whilst steaming across the Atlantic outside of the MGO ‘zones’ at each end currently amount to approximately $85/teu, which is why shippers have been alerted the way they have. Including the MGO zones, the current total round voyage HFO cost of the first is around $135/teu, and for the second it is $185/teu.

Table 1

Extra R/V Costs of Service Between Northern Europe and USEC Calling at New York, Norfolk and Charleston Only

Source: Drewry Maritime Research

Table 2

Extra R/V costs of Service Between Northern Europe and USEC/USG Calling at Charleston, Port Everglades, Houston, Savannah and Norfolk

Source: Drewry Maritime Research

These calculations are only reasonable estimates, and are not final – not least because the future price of MGO is unknown. More importantly, as made clear at the outset, the extra fuel costs will greatly vary by ship size, by port rotation and by trade route.

The extra cost will be higher for the many smaller and older ships on the transatlantic route.

But the extra cost will be much lower for the Asian routes to and from North America and North Europe, partly because they are involved in only one Emission Control area (Asia is not affected, yet) and partly because ships on these Asian routes are far more fuel efficient.

Watch this space.

Our View

The industry must look more closely at the cost impact of the low-sulphur regulation, so that carriers and shippers can negotiate and manage the cost increases in good time.

Source: Drewry Maritime Research

Northern Europe’s and North America’s Emission Control Areas

Out of the three alternatives, only consuming MGO at sea is practical in the short-to-medium term. Although some deep-sea ships are now being ordered with duel LNG/HFO fuel engines, the loss of cargo space required for their fuel tanks is enormous, and major cities are still reluctant to see fuelling stations for hazardous gas like LNG built in nearby ports. Ship exhaust scrubbers may also rule the world one day, but few, if any, container ships have them installed yet.

As MGO fuel is currently around $300 per tonne more expensive that HFO 1.0%S, several ocean carriers have started warning customers to expect a surcharge. The following statement from Hapag-Lloyd on 7 November 2013 is a good example: ‘For all freight rates with a validity in 2015, customers will have to amend their bunker formulas to cover the increasing costs for low sulphur fuel oil. Otherwise, Hapag-Lloyd reserves the right to charge an increased LSF surcharge separately once all cost components are confirmed.’

So far Hapag-Lloyd has only mentioned that it will bear an additional fuel burden of $120-200 million based on today’s fuel prices and service network. Maersk/Safmarine/Seago have mentioned an additional fuel cost of about $200 million.

As no carrier has yet been more specific, Drewry has done its own research into the extra costs involved and the likely consequences of the new environmental regulation.

The cost analysis is not easy as it depends on several variables, including;

the port rotation of each service, and the resulting sailing time spent in the relevant ECAs (i.e. in the US, in Northern Europe or in both)

the daily fuel consumption of each ship (larger, more economical ships will incur lower per-unit extra costs)

how long before entering each ECA ships will be compelled to switch from HFO to MGO in order to ensure compliance

the extra engine wear and tear resulting from burning MGO instead of HFO

the future cost differential between HFO 1.0%S and more expensive MGO

Out of these, factors (4) and (5) are the hardest to predict, in Drewry’s opinion.

Factors (1) and (2) are not only route-specific, but also port-specific, so there will be differences between each trade routes’ and services’ extra costs caused by the new low-sulphur rule.

Each trade lane has very different economies of scale. The average size of vessel deployed between Asia and Northern Europe is now a massive 11,200 teu, compared to only 6,450 teu between Asia and USWC, and 4,100 teu between the USEC/Gulf and Northern Europe, for example. And within each route, the average size of vessel deployed in services can also vary enormously, ranging from 8,000 teu to 18,000 teu between Asia and North Europe. Also, some ships are far more fuel efficient than others, and run at different speeds when crossing ECAs in different directions, and it is not always evident when the change-overs occur.

Another complication is that ocean carriers serve trade lanes in different ways, with some schedules involving more coastal steaming within ECAs than others. Some ships sailing between Northern Europe and ECNA only go as far as Savannah, whilst others go on to Houston, for instance. So, if a carrier wants to add a port of call which results in having to bear the cost of the more expensive fuel for say 300 miles within an Emission Control area, the incremental fixed cost of adding this port call will be much higher than it is today.

This means that the low-sulphur regulation could:

eventually lead to vessels calling at fewer direct ports within Emission Control areas

discriminate between ports located within Emission Control areas (eg Northern France) and those outside (eg Mediterranean France)

discriminate between upriver ports (requiring more time sailing) and coastal ports within Emission Control areas

substantially increase the cost advantage of larger, more fuel efficient ships over smaller, older ships

increase costs for carriers and for shippers

But how much will this extra cost be?

We provide here an estimate of the additional cost to the carrier of the low-sulphur regulation for two transatlantic services only, but it should be borne in mind that other routes, such Asia/North Europe and Asia/North America, will be far less costly due to there being only one ECA involved. Drewry has analysed these routes too, but the results go beyond the scope of this particular piece of free analysis.

As can be seen from Tables 1 and 2, the round voyage cost differential of services operating between Northern Europe and USEC is approximately $29/teu, and the difference between Northern Europe and the US Gulf is $49/teu. There will also be additionals for feeding cargo between Continental ports and the Baltic, and between Continental ports and the UK East and West coasts. For a typical round voyage between Hamburg and St Petersburg, the cost will be a further $21/teu, for example.

The calculations assume that the cost differential between MGO and HFO 1.0%S will increase from $300/tonne now to $320/tonne in 2015. This is because the differential could well increase due to increased demand for MGO. Fuel consumption between MGO and HFO is assumed to be the same. It is possible that carriers will want to charge for extra engine wear and tear caused by burning MGO instead of HFO whilst at sea, but this factor has been ignored in the calculations. The same applies to the extra deep-sea distance ocean carriers will have sail in order to ensure that transits across each ECA is minimised. We assume that ships will switch to MGO half a day before entering each ECA in order to clean all pipes/filters in good time.

The extra cost on a per teu basis may seem low compared to the global ‘telephone’ numbers, mentioned by Maersk and Hapag-Lloyd at the outset, but it should be borne in mind that the costs will represent a significant part of ocean carriers’ overall fuel bill. For example, for the two services mentioned, ocean carriers’ HFO cost whilst steaming across the Atlantic outside of the MGO ‘zones’ at each end currently amount to approximately $85/teu, which is why shippers have been alerted the way they have. Including the MGO zones, the current total round voyage HFO cost of the first is around $135/teu, and for the second it is $185/teu.

Table 1

Extra R/V Costs of Service Between Northern Europe and USEC Calling at New York, Norfolk and Charleston Only

Source: Drewry Maritime Research

Table 2

Extra R/V costs of Service Between Northern Europe and USEC/USG Calling at Charleston, Port Everglades, Houston, Savannah and Norfolk

Source: Drewry Maritime Research

These calculations are only reasonable estimates, and are not final – not least because the future price of MGO is unknown. More importantly, as made clear at the outset, the extra fuel costs will greatly vary by ship size, by port rotation and by trade route.

The extra cost will be higher for the many smaller and older ships on the transatlantic route.

But the extra cost will be much lower for the Asian routes to and from North America and North Europe, partly because they are involved in only one Emission Control area (Asia is not affected, yet) and partly because ships on these Asian routes are far more fuel efficient.

Watch this space.

Our View

The industry must look more closely at the cost impact of the low-sulphur regulation, so that carriers and shippers can negotiate and manage the cost increases in good time.

Source: Drewry Maritime Research