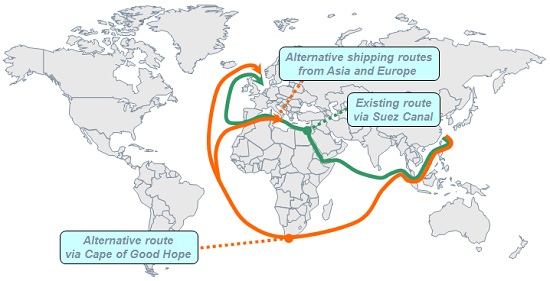

Recent political unrest in Egypt has again raised the spectre of the Suez Canal closing. However, if it were to be suddenly closed tomorrow, it would not be a train smash for the container industry. Vessel schedules could be immediately adjusted to minimise delays. The low probability of the Suez Canal closing has increased due to the threat of terrorist activity from either the ousted Muslim Brotherhood party or one of its rivals for power.

However, there are still more than enough container ships to cope with the extra distance of sailing between Asia and Europe around the Cape of Good Hope, with transit times remaining little longer due to their reserves of speed. As calculated in March, (see ‘What if the Suez Canal was shut?’, March 18), average container vessel speed only has to be increased to 22k in each direction to avoid the loss of time, still leaving a safety margin against a top speed of between 24/25k.

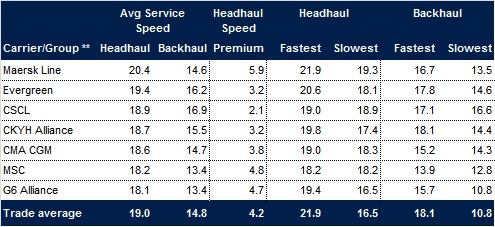

Vessels sailing from Asia to Northern Europe continued to be run at an average speed of only 19k in June, but on the way back the average decreased slightly from 14.9k to 14.8k, despite the price of fuel in Rotterdam dropping from around $650/tonne to $615/tonne, although it increased to $630/tonne at the beginning of July, and will increase again should the canal be closed.

Estimated service speeds, Asia-North Europe trade* (kn)

* Last Load Port to First Discharge Port transit time derived from carrier schedules as of June 2013

* Last Load Port to First Discharge Port transit time derived from carrier schedules as of June 2013** May not include all services of any carrier/group. May include services not operated by all group lines

Source: Drewry Maritime Research

Partially offsetting this fuel saving, the Suez Canal raised its tolls by 2% in May. According to the latest information from the Suez Canal Authority, vessels continue to take between 12-16 hours to transit the artery using its convoy system that requires vessel speeds to be reduced to between 11-16k, depending on ship type and size.

Moreover, the canal remains as popular as ever; in fact, more so now that additional vessels between Asia and the East Coast of North America are being routed via Suez instead of Panama (since May). Although the total number of container vessels transiting the canal in the first three months of the year reduced by 6.7% compared to the same period last year, down to 1,479, their average size increased by 0.6%, up to 121,522 net tons. Northbound containerised cargo reduced by 0.5%, down to 48.5 million tons, whereas southbound cargo fell by a higher 2.4%, down to 47,381 tons, which was surprisingly well balanced bearing in mind Europe’s chronic trade imbalance with Asia (measured in teu).

To help put this into perspective, two-way trade between Asia and Europe reached a massive 20.1 million teu last year, compared to 5.2 million teu to/from the Indian Subcontinent/Middle East, and 688,000 teu to/from Australasia/Oceania.

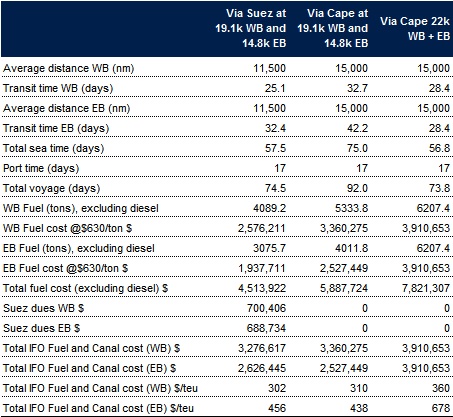

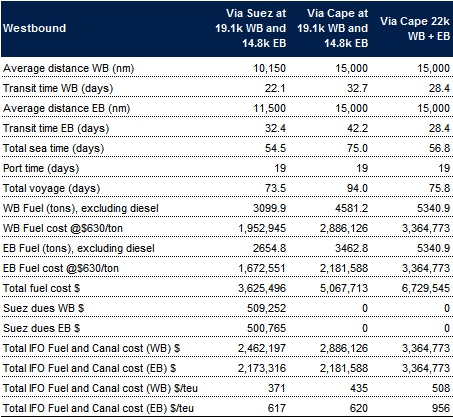

As shown in the table below, it is still possible for a schedule deploying 13,100 teu vessels travelling at 22k in each direction between Asia and Northern Europe to deviate around the Cape in approximately the same time as via Suez at current speeds (averaging 19.1k westbound and 14.8k eastbound). However, after taking into account the saving made by avoiding Suez transits, shippers would have to pay an extra westbound and eastbound deviation surcharge of around $58/teu and $222/teu respectively (assuming IFO fuel price of $630/ton), although ocean carriers would probably want to distribute this more evenly.

Comparison of Suez and Cape transits between Asia/N Europe for 13,100 teu vessels (approximate)

Notes: No allowance made for slow steaming in port, Suez, or anti-piracy convoys

Fuel consumption at 19.1k 163t/day; at 14.8k 95t/day; at 22k 218.5t/day

Average vessel utilisation WB 85%, EB 55%. Cost of diesel excluded

Source: Drewry Maritime Research

In the case of a 10,000 teu vessel, the extra cost would be $66/teu and $248/teu respectively (Both very approximate calculations ignore the extra cost of diesel, and savings made by avoiding anti-piracy convoys through the Gulf of Oman.

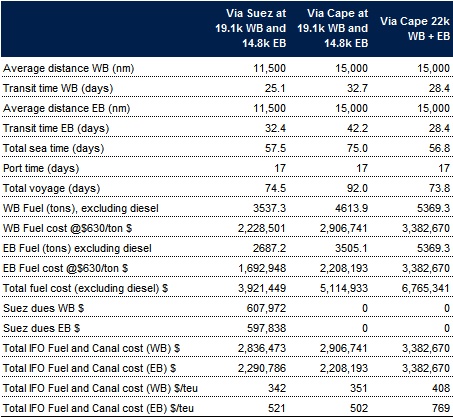

Comparison of Suez and Cape transits between Asia/N Europe for 10,000 teu vessels (approximate)

Notes: No allowance made for slow steaming in port, Suez, or anti-piracy convoys

Fuel consumption at 19.1k 141t/day; at 14.8k 83t/day; at 22k 189t/day

Average vessel utilisation WB 85%, EB 55%. Cost of diesel excluded

Source: Drewry Maritime Research

Schedules operating from the Far East to Mediterranean would be more difficult to maintain due to having to enter the Mediterranean via the strait of Gibraltar instead of Suez. However, assuming port rotations were adjusted accordingly, and some transhipment, services could still be maintained via the Cape with the same number of vessels. As shown in the table below, 8,000 teu vessels would incur a westbound and eastbound deviation surcharge of approximately $137/teu and $339/teu respectively, but, here again, ocean carriers would probably want to distribute this more evenly.

Comparison of Suez and Cape transits between Asia/Med for 8,000 teu vessels (approximate)

Notes: No allowance made for slow steaming in port, Suez, or anti-piracy convoys

Notes: No allowance made for slow steaming in port, Suez, or anti-piracy convoysFuel consumption at 19.1k 140t/day; at 14.8k 82t/day; at 22k 188t/day

Average vessel utilisation WB 85%, EB 55%. Cost of diesel excluded

Service via Cape at 22k assumes some transhipment in the Med

Source: Drewry Maritime Research

The further complication of replacing the capacity provided by vessels stopping off in the Mediterranean en route from the Far East to Northern Europe remains, but direct services still currently have enough spare capacity for this.

The maintenance of schedules between the Indian Subcontinent/Middle East and Europe would also still have to be dealt with as explained previously.

Our View

The Suez canal is a key component in Asia-Europe container trade, and is becoming more important for Asia-US East Coast trade, too. If it were to be suddenly closed tomorrow, container vessel schedules between Asia and Europe could be immediately adjusted to minimise delays by simply increasing speed to 22k in each direction. Shippers would have to pay a hefty surcharge to cover the cost of deviating around the Cape of Good Hope, however.

Source: Drewry Maritime Research